Services

Business Services

Pan Card

Eligibility Criteria:

- Individuals, HUFs, firms, companies, and trusts are eligible.

- PAN is essential for financial transactions and income tax.

Documents Required:

- Proof of Identity: Aadhar card, Passport, Voter ID, Driving License.

- Proof of Address: Aadhar card, Passport, Voter ID, Utility bill.

- Proof of Date of Birth: Birth certificate, Passport, Aadhar card.

- Photograph: Recent passport-sized color photograph.

- Form 49A or 49AA: Duly filled and signed application form.

- Fee Payment: Pay the applicable processing fee.

- Additional documents may be required for entities and NRIs.

- Minors require guardian’s documents and a birth certificate.

- Ensure all documents match the application information.

Shop Act

Shop Act License Registration:

- Shop Act License, also known as the Gumasta License, is a mandatory registration for businesses operating within a state in India.

- It is governed by the Shops and Establishments Act of the respective state.

- The primary purpose is to regulate the working conditions and terms of employment for employees in commercial establishments.

- The registration is required for all types of businesses, including shops, hotels, restaurants, and other commercial establishments.

- The registration process and requirements may vary from state to state.

Documents Required for Shop Act License:

- Proof of Identity: Aadhar card, Passport, Voter ID, or any government-issued photo ID.

- Proof of Address: Utility bill, rental agreement, or any document verifying the business address.

- Passport-sized photographs of the business owner/partner/director.

- PAN card of the business entity (if applicable).

- Details of employees, such as their names, addresses, and photographs.

- Partnership deed, incorporation certificate, or other business-specific documents.

- Any other documents required by the state-specific Shops and Establishments Act.

GST

GST Registration:

- GST is a comprehensive indirect tax levied on the supply of goods and services in India.

- GST registration is mandatory for businesses with an annual turnover exceeding specified thresholds.

- It helps streamline the taxation system by replacing various indirect taxes like VAT, excise duty, and service tax.

Eligibility for GST Registration:

- Businesses with an aggregate turnover exceeding the prescribed threshold limit (currently ₹40 lakhs for most states, ₹20 lakhs for some special category states).

- Certain businesses, like e-commerce operators, are required to register for GST, regardless of turnover.

- Voluntary registration is also possible, even if turnover is below the threshold.

Documents Required for GST Registration:

- Proof of Identity: PAN card of the business owner/partner/director.

- Proof of Address: Aadhar card, passport, voter ID, or any government-issued address proof.

- Photographs of the business owner/partner/director.

- Business-specific documents like the partnership deed, certificate of incorporation, or registration under other laws.

- Bank account details and canceled cheque.

- Digital signature (for certain cases).

Food Licence

Eligibility Criteria:

- Any entity or individual involved in food manufacturing, processing, packaging, storage, distribution, and sale is eligible to apply for an FSSAI license.

- The type of FSSAI license required (Basic, State, or Central) depends on the scale and nature of your food business.

Documents Required:

Identity and Address Proof:

- For Individuals: Aadhar card, Passport, Voter ID, or Driver’s License.

- For Business Entities: Incorporation certificate, Partnership deed, or any other relevant business registration document.

- Proof of address for the business premises, such as a rent agreement or property documents.

Passport-sized Photographs: Recent photographs of the proprietor/partner/director of the food business.

Food Safety Management System Plan: Required for certain categories of businesses. This plan outlines how food safety will be managed in your business.

List of Food Products: A comprehensive list of the food products to be manufactured or processed by your business.

Form B: The application form for the FSSAI license, duly completed and signed.

Declaration Form: A declaration stating that the food business complies with FSSAI regulations.

Certificate of Incorporation/Partnership Deed: Relevant business registration documents for entities other than individuals.

Affidavit: An affidavit stating that the food business will comply with food safety standards.

Layout Plan: A layout plan of your food business premises showing the dimensions, location of equipment, and the area allocated for various food operations.

No Objection Certificate (NOC): If applicable, you may need an NOC from the Municipality or Panchayat.

Trademark/Brand Name Registration Certificate: If you have registered your food product’s brand name or trademark, provide the certificate.

Passport

Passport Application:

- A passport is an official travel document that serves as proof of identity and nationality.

- It is issued by the Ministry of External Affairs, Government of India, through the Passport Seva Kendras (PSKs).

Eligibility:

- Indian citizens of all ages are eligible to apply for a passport.

- Certain documentation and additional requirements may apply to minors and government employees.

Documents Required:

Proof of Identity: Any one of the following documents:

- Aadhar Card

- Voter ID

- PAN Card

- Driving License

- School Leaving Certificate

- Birth Certificate

Proof of Address: Any one of the following documents:

- Aadhar Card

- Voter ID

- Utility Bill (electricity, water, gas)

- Rental Agreement

- Passport of parents (for minors)

Date of Birth Proof: Any one of the following documents:

- Birth Certificate

- School Leaving Certificate

- PAN Card

Passport-sized Photographs: Recent passport-sized color photographs.

Any Previous Passport: If you have had a previous passport, provide details of that passport.

ITR

Income Tax Return (ITR):

- ITR is a document that individuals and businesses in India use to report their income, deductions, and taxes to the Income Tax Department.

- It’s a way for taxpayers to calculate and pay their income tax liability.

Eligibility:

- Any individual, Hindu Undivided Family (HUF), company, firm, or other entities with taxable income is required to file an ITR.

- Even if your income is below the taxable limit, you may still file ITR to claim refunds or for compliance purposes.

Types of ITR Forms:

- There are different ITR forms available, and the one you need to use depends on your income sources and the complexity of your financial situation.

- Common forms include ITR-1 (Sahaj), ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, and ITR-7.

Documents Required for ITR Filing:

PAN (Permanent Account Number) Card: This is essential for filing an ITR.

Form 16: If you are a salaried individual, your employer will provide Form 16, which contains details of your salary, TDS deductions, and other income.

Bank Statements: Copies of bank statements showing your income and expenses.

Investment Proof: Documents related to investments eligible for tax deductions under various sections of the Income Tax Act (e.g., 80C, 80D, 80G).

Property Documents: If you own property, you need details of rental income or property transactions.

Other Income Proof: Details of income from other sources, such as interest, dividends, or capital gains.

Aadhar Card: Linking your Aadhar card to your PAN card is mandatory for ITR filing.

DSC Class 3

Eligibility Criteria:

- Class 3 DSC can be obtained by individuals, organizations, and government entities.

- There are no specific restrictions on eligibility, but the need for Class 3 DSC arises when a higher level of security and identity verification is required for online transactions and interactions.

Documents Required for Class 3 DSC:

Proof of Identity: Any one of the following documents:

- Passport

- Aadhar Card

- Voter ID

- Driver’s License

- PAN Card

Proof of Address: Any one of the following documents:

- Aadhar Card

- Voter ID

- Utility Bill (electricity, water, gas)

- Bank Statement

- Rent Agreement

Passport-sized Photographs: Recent passport-sized color photographs of the applicant.

Organization Documents (if applicable): In the case of organizations, additional documents may be required, such as:

- Certificate of Incorporation

- Partnership Deed

- Memorandum of Association

- Articles of Association

Authorized Signatory Documents: If the DSC is for an organization, documents proving the authorization of the signatory to apply for the DSC.

Digital Signature Application Form: The DSC application form duly filled and signed by the applicant.

Payment Receipt: Proof of payment of the DSC issuance fee.

Additional Documents: Depending on the Certifying Authority (CA) and the specific use case, additional documents or verification steps may be required.

TDS Return

Eligibility Criteria:

- Any entity or individual who makes payments subject to TDS, such as employers, businesses, and government entities, is required to file TDS returns.

- TDS returns are filed by the deductor, i.e., the entity responsible for deducting tax at source.

Documents Required for TDS Return Filing:

TDS Challan: Proof of tax deposited with the government. Challan 281 is commonly used for TDS payment.

TDS Certificates: Form 16 (for salary income) or Form 16A (for non-salary income) issued to the deductees.

PAN (Permanent Account Number): PAN details of both the deductor and the deductees.

Details of Deductees: This includes the deductee’s name, PAN, address, and the amount of income paid and TDS deducted.

TAN (Tax Deduction and Collection Account Number): The deductor’s TAN, which is used for TDS reporting.

Income Details: Details of the income on which TDS was deducted.

Bank Account Details: Bank account details for TDS refunds, if applicable.

TDS Return Form: Depending on the type of income, different TDS return forms are used, such as Form 24Q for salary, Form 26Q for non-salary, and others.

ISO Certificate

ISO Certification:

- ISO certification is a globally recognized certification that demonstrates a business’s commitment to meeting specific international standards for quality, environmental management, information security, and more.

- Different ISO standards are available, such as ISO 9001 (Quality Management), ISO 14001 (Environmental Management), ISO 27001 (Information Security Management), and many others.

Eligibility:

- ISO certification is open to businesses of all sizes and types, including manufacturing, services, and non-profit organizations.

- The eligibility criteria depend on the specific ISO standard you are seeking certification for.

Documents Required:

Quality Manual: A document that outlines your organization’s quality management system.

Standard Operating Procedures (SOPs): Detailed procedures and instructions related to various processes within your organization.

Records and Evidence: You will need to provide records and evidence of your compliance with the specific ISO standard. This may include meeting minutes, audit reports, and other relevant documentation.

Training Records: Documentation of employee training related to quality management, if applicable.

Audit Reports: Reports from internal and external audits of your management system.

Corrective and Preventive Actions (CAPA): Documentation of any corrective and preventive actions taken to address non-conformities or improve processes.

Partnership Online Registration

Eligibility Criteria for Partnership Registration:

Minimum Partners: A partnership firm in India must have a minimum of two partners. There can be a maximum of 20 partners in a non-banking business and ten partners for a banking business.

Partners’ Eligibility: Partners can be individuals or other legal entities, such as LLPs (Limited Liability Partnerships) or registered companies. Minors, insolvent individuals, and those declared as unsound mind cannot be partners.

Partnership Deed: A partnership deed is a legal document that outlines the terms and conditions of the partnership. It should include details such as the firm’s name, business activities, profit-sharing ratio, and the rights and responsibilities of each partner.

Documents Required for Online Partnership Registration:

Identity Proof: Valid identity proofs of all the partners, including Aadhar card, passport, voter ID, or driver’s license.

Address Proof: Address proofs of all partners, such as Aadhar card, passport, voter ID, utility bills, or rent agreement.

PAN Card: PAN (Permanent Account Number) card details of all partners.

Partnership Deed: A properly drafted partnership deed signed by all partners. It’s advisable to consult a legal expert or a chartered accountant to create a comprehensive partnership deed.

Address Proof of the Firm: Proof of the firm’s registered office address, such as a utility bill or rent agreement.

Firm Name Approval: In some cases, you may need to obtain approval for the partnership firm’s name from the Registrar of Companies (ROC) or the respective state authority.

Export & Import Code

Eligibility Criteria for IEC:

Entities Eligible for IEC: The following entities are eligible to apply for an IEC:

- Individuals

- Partnership firms

- Limited liability partnerships (LLPs)

- Registered companies

- Societies

- Trusts

- Hindu Undivided Families (HUFs)

- Proprietorship firms

No Minimum Capital Requirement: There is no minimum capital requirement to obtain an IEC. Even small businesses and individuals can apply for it.

Documents Required for IEC:

PAN (Permanent Account Number) Card: A copy of the PAN card of the applicant entity (individual or business).

Address Proof: Address proof of the applicant, which can be one of the following:

- Aadhar card

- Voter ID

- Passport

- Driving License

- Bank statement

Bank Certificate: A canceled cheque or a bank certificate issued by the applicant’s bank with the firm’s name pre-printed on it.

Entity Proof: Depending on the type of entity, the following documents may be required:

- Partnership firm: Partnership deed

- Company: Certificate of incorporation

- LLP: LLP agreement

- Trust/Society: Registration certificate

Letter of Authorization: In case the application is submitted by an authorized signatory, a letter of authorization is required.

Digital Photograph: A passport-sized photograph of the applicant or the authorized signatory.

PTEC/PTRC

Eligibility

PTEC

Any person who is liable to pay professional tax in the state of Maharashtra is eligible for PTEC registration. This includes:

- Individuals who are engaged in any profession, business, or employment in the state of Maharashtra.

- Companies, firms, and other business entities that are registered in the state of Maharashtra.

PTRC

Any employer who is liable to deduct professional tax from the salary of its employees in the state of Maharashtra is eligible for PTRC registration. This includes:

- Companies

- Firms

- Societies

- Trusts

- Individuals who employ one or more persons

Documents required

The following documents are required for PTEC and PTRC registration:

- PAN card

- Aadhaar card

- Address proof of the principal place of business (electricity bill, property tax receipt, etc.)

- Photograph of the applicant

- Cancelled cheque

- Proof of constitution of the business (certificate of incorporation, partnership deed, etc.)

- Salary details of employees (for PTRC registration only)

Contact Us Today

PF Registration

PF Registration Eligibility

The following establishments are eligible for PF registration:

- Factories with 20 or more employees

- Any other establishment with 20 or more employees, or a class of similar establishments specified by the central government

- Establishments that have been exempted from compulsory PF registration by the central government

PF Registration Documents

The following documents are required for PF registration:

- PAN card of the employer

- Aadhaar card of the employer

- Address proof of the establishment

- Bank statement or cancelled cheque of the establishment

- List of employees with their details (name, date of birth, father’s name, date of joining, salary, etc.)

- Digital signature of the employer

Logo / Tradmark Registration

Any person or business entity can apply for logo or trademark registration in India. This includes:

- Individuals

- Companies

- Firms

- Societies

- Trusts

Logo / Trademark Registration Documents

The following documents are required for logo or trademark registration in India:

- Logo or trademark in black and white

- Form TM-1

- Power of attorney (if filed through a trademark agent)

- Copy of the applicant’s PAN card

- Copy of the applicant’s Aadhaar card

- Copy of the applicant’s address proof

Leave and License Agreement

Eligibility

Any person or business entity can enter into a leave and license agreement. However, it is important to note that a leave and license agreement does not create any interest in the property in favor of the licensee. This means that the licensee does not have any ownership rights over the property and can be asked to vacate the property at any time by the licensor.

Documents required

The following documents are typically required for a leave and license agreement:

- PAN card of the licensor and the licensee

- Aadhaar card of the licensor and the licensee

- Address proof of the licensor and the licensee

- A copy of the title deed of the property

- A copy of the property tax receipt

- A copy of the electricity bill

- A copy of the water bill

Partnership Deed

Eligibility

Any two or more people can enter into a partnership deed. However, it is important to note that all of the partners must be legally competent to enter into a contract. This means that they must be of the legal age of majority and must not be mentally incapacitated.

Documents required

The following documents are typically required for a partnership deed:

- PAN card of all the partners

- Aadhaar card of all the partners

- Address proof of all the partners

- A copy of the partnership deed

Affidavit

An affidavit is a sworn statement that is written down and signed in front of a notary public. It is a legal document that can be used to prove facts in court or in other legal proceedings. Affidavits can also be used for other purposes, such as to verify your identity or to support a claim for insurance benefits.

Eligibility

Anyone can make an affidavit, as long as they are of legal age and mentally competent to understand the nature of the statement they are making.

Documents required

The only document required to make an affidavit is a valid form of identification, such as a driver’s license or passport.

How to make an affidavit

To make an affidavit, you will need to write down your statement and then sign it in front of a notary public. The notary public will then verify your signature and attach their seal to the affidavit.

What to include in an affidavit

An affidavit should include the following information:

- Your full name and address

- The date and time that the affidavit is being made

- A statement that you are of legal age and mentally competent to make the affidavit

- A statement that the facts contained in the affidavit are true to the best of your knowledge

- Your signature

Examples of affidavits

Some examples of affidavits include:

- Affidavits of identity

- Affidavits of support

- Affidavits of witness

- Affidavits of loss

- Affidavits of service

Tax Audit

The following entities are required to undergo a tax audit in India:

- Individuals and HUFs with a total income of more than INR 50 lakh

- Companies and firms with a total income of more than INR 1 crore

- Individuals and HUFs who carry on business or profession, where the turnover or gross receipts exceed INR 1 crore

- Persons who are required to get their accounts audited under any other law, such as the Companies Act, 2013

Documents required for tax audit

The following documents are required for a tax audit:

- Financial statements, such as the balance sheet, profit and loss account, and cash flow statement

- Books of account, such as the ledger, journal, and cash book

- Supporting documents, such as invoices, receipts, and vouchers

Statutory audit

Eligibility for statutory audit

The following entities are required to undergo a statutory audit in India:

- All companies registered under the Companies Act, 2013

- Limited liability partnerships (LLPs)

- Public trusts

- Societies registered under the Societies Registration Act, 1860

- One Person Companies (OPCs)

- Foreign companies with a place of business in India

Documents required for statutory audit

The following documents are required for a statutory audit:

- Financial statements, such as the balance sheet, profit and loss account, and cash flow statement

- Books of account, such as the ledger, journal, and cash book

- Supporting documents, such as invoices, receipts, and vouchers

- Any other documents that the auditor may require

How to get a statutory audit done

A statutory audit must be done by a chartered accountant (CA) who is registered with the Institute of Chartered Accountants of India (ICAI). To get a statutory audit done, you need to appoint a CA and submit the required documents to them. The CA will then review your accounts and prepare a statutory audit report.

Company Registration

Eligibility for company registration in India

To register a company in India, you must meet the following eligibility criteria:

- At least two directors are required, one of whom must be an Indian resident.

- At least two shareholders are required.

- The company must have a registered office in India.

- The company must have a valid company name.

Documents required for company registration in India

The following documents are required to register a company in India:

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Form INC-9 (Declaration by the first directors)

- Form INC-10 (Declaration by the subscriber to the Memorandum of Association)

- Form INC-11 (Consent to act as director)

- Form INC-12 (Notice of situation of registered office)

- Form INC-13 (Particulars of the subscribers of the Memorandum of Association)

- Proof of identity and address of the directors and shareholders

- Digital signature certificates (DSCs) for the directors and shareholders

Contact Us Today

Nidhi Company

Eligibility for Nidhi Company registration

- The company must be a public limited company.

- The company must have a minimum of seven members and three directors.

- The registered office of the company must be located in India.

- The company must have a minimum paid-up share capital of Rs. 5 lakh.

- The company must have a distinctive name that ends with the suffix “Nidhi Limited”.

- The company must be formed for the purpose of cultivating the habit of thrift and savings amongst its members, receiving deposits from its members, and lending money to its members only.

Documents required for Nidhi Company registration

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Form NDH-1 (Application for registration of Nidhi Company)

- Form NDH-2 (Declaration by the first directors)

- Form NDH-3 (Declaration by the subscribers to the Memorandum of Association)

- Form NDH-4 (Consent to act as director)

- Form NDH-5 (Notice of situation of registered office)

- Form NDH-6 (Particulars of the subscribers of the Memorandum of Association)

- Proof of identity and address of the directors and shareholders

- Digital signature certificates (DSCs) for the directors and shareholders

Bank Account Opening

Eligibility for opening a bank account in India

To open a bank account in India, you must meet the following eligibility criteria:

- You must be of legal age (18 years or older).

- You must be a resident of India.

- You must be mentally competent to understand the terms and conditions of the account.

Documents required for opening a savings bank account in India

The following documents are typically required to open a savings bank account in India:

- Proof of identity (Aadhaar card, PAN card, voter ID card, driving license, passport, etc.)

- Proof of address (Aadhaar card, utility bill, bank statement, etc.)

- Passport size photographs

- Initial deposit amount

Start Up India Reg.

Eligibility for Startup India registration

To be eligible for Startup India registration, an entity must meet the following criteria:

- It must be a private limited company, registered partnership firm, or limited liability partnership (LLP).

- It must not have been formed by splitting up or reconstructing an existing business.

- It must be incorporated or registered in India within the past 10 years.

- Its annual turnover must not exceed INR 100 crore in any of the previous 10 financial years.

- It must be working towards innovation, development, or improvement of products or processes or services, or its scalability in terms of employment generation or wealth creation.

Documents required for Startup India registration

The following documents are required to register for Startup India:

- Certificate of incorporation or registration of the entity

- Memorandum of Association (MOA) and Articles of Association (AOA) of the company (in case of a private limited company)

- Partnership deed (in case of a registered partnership firm)

- LLP agreement (in case of an LLP)

- Proof of concept, such as a website link, video, or pitch deck

- Self-certification of the startup entity’s eligibility for Startup India registration

LLP Registration

Eligibility for LLP Registration

Any two or more persons can form an LLP in India. There is no minimum capital requirement for LLP registration. The following persons are not eligible to form an LLP:

- A minor

- An unsound mind

- An insolvent person

- A person who has been convicted of an offense involving moral turpitude

Documents required for LLP Registration

The following documents are required for LLP registration in India:

- Digital Signature Certificates (DSCs) for all designated partners

- Director Identification Number (DIN) for all designated partners

- Proposed name of the LLP

- Registered office address of the LLP

- Identity and address proof of all partners

- LLP Agreement

12A AND 80G Reg For NGO

Eligibility for 12A and 80G Registration

To be eligible for 12A and 80G registration, an NGO must meet the following criteria:

- It must be a charitable or religious trust, society, or section 8 company.

- It must have been established for charitable or religious purposes.

- It must not be engaged in any commercial activity.

- It must have a well-defined governing body and a transparent management system.

- It must have a track record of at least three years of charitable work.

Documents required for 12A and 80G Registration

The following documents are required for 12A and 80G registration:

- Trust deed/society registration certificate/section 8 company certificate

- PAN card of the NGO

- Copies of the NGO’s bank statements and income tax returns for the past three years

- List of the NGO’s governing body members and their details

- List of the NGO’s activities and beneficiaries

- Any other documents required by the Income Tax Department

Trust Registration

Eligibility for Trust Registration in India

To be eligible for trust registration in India, the trust must meet the following criteria:

- It must be created for a charitable or religious purpose.

- It must have a well-defined trust deed.

- It must have at least two trustees, who must be of legal age and sound mind.

- It must have a permanent office address in India.

Documents required for Trust Registration in India

The following documents are required for trust registration in India:

- Trust deed

- PAN card of the trust

- Proof of identity and address of the trustees

- Proof of the trust’s office address

- Any other documents required by the Registrar of Trusts in your state/union territory

Society Registration

Eligibility for Society Registration in India

To be eligible for society registration in India, the society must meet the following criteria:

- It must be formed for a literary, scientific, charitable, religious, or social purpose.

- It must have at least seven members.

- It must have a well-defined set of rules and regulations.

- It must have a permanent office address in India.

Documents required for Society Registration in India

The following documents are required for society registration in India:

- Memorandum of Association (MOA)

- Rules and Regulations of the society

- List of the society’s members and their details

- Proof of identity and address of the society’s governing body members

- Proof of the society’s office address

- Any other documents required by the Registrar of Societies in your state/union territory

Labour Licence

Eligibility for Labour Licence in India

To be eligible for a labour licence in India, the following criteria must be met:

- The employer must be engaged in a business or industry that requires a labour licence.

- The employer must have a valid establishment registration certificate.

- The employer must have a permanent place of business in India.

- The employer must comply with all applicable labour laws and regulations.

Documents required for Labour Licence in India

The following documents are typically required for labour licence application in India:

- Application form (Form IV)

- Establishment registration certificate

- Proof of ownership or lease of the premises

- List of employees and their wages

- Copy of the employment contract

- Copies of relevant labour laws and regulations

- Any other documents required by the labour commissioner in your jurisdiction

Contact Us Today

PASARA Registration

Eligibility for PASARA Registration

To be eligible for PASARA registration, the following criteria must be met:

- The applicant must be a company or a limited liability partnership (LLP).

- The applicant must have a permanent place of business in India.

- The applicant must have a minimum paid-up capital of Rs. 10 lakh.

- The applicant must have at least two directors, one of whom must be a resident of India.

- The applicant must have at least two employees, who must have undergone the prescribed security training.

Documents required for PASARA Registration

The following documents are typically required for PASARA registration:

- Application form

- Memorandum of Association (MOA) and Articles of Association (AOA) of the company or LLP agreement

- Proof of incorporation or registration of the company or LLP

- Proof of permanent place of business in India

- Proof of paid-up capital

- Identity and address proof of the directors and employees

- Security training certificates of the employees

- Any other documents required by the licensing authority in your state/union territory

ESIC Registration

Eligibility for ESIC Registration

The following entities are required to register under the ESIC Act:

- All factories where 10 or more persons are employed

- All establishments (other than factories) where 20 or more persons are employed

- Any other establishment notified by the Central Government

Documents required for ESIC Registration

The following documents are required for ESIC registration:

- Form 1: Application for Registration of Employer

- Copy of the establishment’s registration certificate

- Proof of address of the establishment

- List of employees and their wages

- Copy of the bank statement of the establishment

- Any other documents required by the ESIC

Sec 8 Company (Ngo)

Eligibility for Sec 8 Company (NGO) Registration in India

To be eligible for Section 8 company registration in India, the company must meet the following criteria:

- It must be formed for a charitable or religious purpose.

- It must have a well-defined Memorandum of Association (MOA) which clearly states the charitable or religious objects of the company.

- It must not distribute any profits to its members.

- It must have a minimum of two directors, one of whom must be a resident of India.

- It must have a minimum paid-up capital of Rs. 1 lakh.

Documents required for Sec 8 Company (NGO) Registration in India

The following documents are typically required for Section 8 company registration in India:

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Form INC-11 (Consent to act as director)

- Form INC-12 (Notice of situation of registered office)

- Form INC-13 (Particulars of the subscribers of the Memorandum of Association)

- Proof of identity and address of the directors and subscribers

- Digital signature certificates (DSCs) for the directors and subscribers

- Any other documents required by the Registrar of Companies (ROC)

RERA Registration

Eligibility for RERA Registration

The following entities are required to register under the Real Estate (Regulation and Development) Act, 2016 (RERA):

- All real estate developers who are engaged in the development of any real estate project where the land area exceeds 500 square meters or the number of apartments proposed to be constructed exceeds eight.

- All real estate agents who are engaged in the sale or purchase of real estate property.

Documents required for RERA Registration

The following documents are typically required for RERA registration:

- Application form

- Proof of identity and address of the applicant

- PAN card of the applicant

- Proof of incorporation or registration of the business (in case of a company or LLP)

- Details of the real estate project(s)

- Audited financial statements of the applicant (in case of a company)

- Any other documents required by the RERA authority in your state/union territory

Project Report

Documents required for a Project Report

The specific documents required for a project report will vary depending on the nature of the project, but typically include the following:

- Executive summary: A high-level overview of the project, including its goals, objectives, scope, and key findings.

- Project overview: A more detailed description of the project, including its background, methodology, and timeline.

- Project findings: A summary of the project’s key findings and conclusions.

- Recommendations: A list of recommendations for future action based on the project’s findings.

In addition to these core documents, you may also want to include the following in your project report, depending on the needs of your audience:

- Appendix: A section containing supplementary information, such as data tables, charts, and graphs.

- References: A list of all sources cited in the report.

Eligibility to write a Project Report

There is no formal eligibility requirement for writing a project report. However, it is important to have a good understanding of the project and its goals, as well as the ability to write clearly and concisely. If you are not sure whether you are qualified to write a project report, it is always a good idea to consult with a supervisor or colleague.

Udyam Registration

Eligibility for Udyam Registration

Any micro, small, or medium enterprise (MSME) in India is eligible for Udyam Registration. MSMEs are defined as follows:

- Micro enterprise: Investment in plant and machinery or equipment does not exceed INR 1 crore and turnover does not exceed INR 5 crore.

- Small enterprise: Investment in plant and machinery or equipment does not exceed INR 10 crore and turnover does not exceed INR 50 crore.

- Medium enterprise: Investment in plant and machinery or equipment does not exceed INR 50 crore and turnover does not exceed INR 250 crore.

Documents required for Udyam Registration

The following documents are required for Udyam Registration:

- Aadhaar card of the proprietor, managing partner, or karta (in case of a Hindu Undivided Family)

- PAN card of the enterprise

- GSTIN (if applicable)

Digital Signature

Eligibility for Digital Signature

Any individual or entity is eligible for a digital signature in India. There are no specific eligibility criteria, but the applicant must be able to provide the required documentation.

Documents required for Digital Signature

The following documents are required to apply for a digital signature in India:

- Aadhaar card

- PAN card

- Proof of address (e.g., voter ID card, driving license, utility bill)

- Passport (in case of a foreign national)

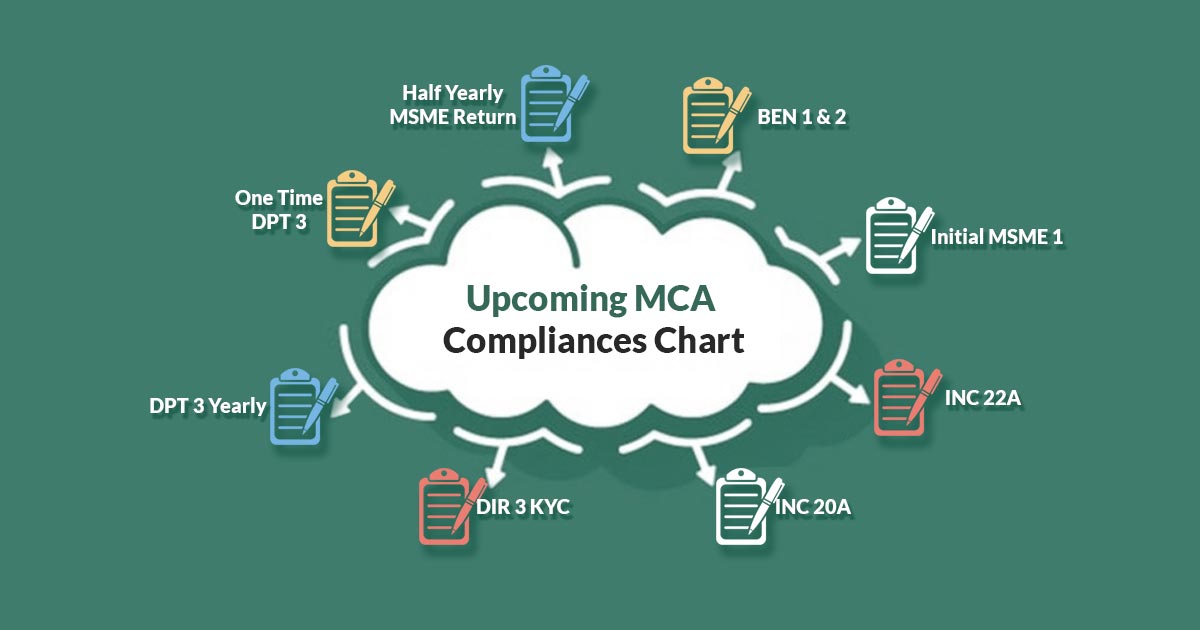

Mca Compliances/ Audit

Required documents for MCA compliances/audit

The following documents are typically required for MCA compliances/audit:

- Financial statements: All companies are required to prepare financial statements for each financial year. The financial statements must be in accordance with the Accounting Standards issued by the Institute of Chartered Accountants of India (ICAI).

- Annual return: The annual return form contains information about the company’s directors, shareholders, financial performance, and other important details.

- Cost audit report: The cost audit report must be prepared by a cost accountant and must contain information about the company’s cost of production and other related expenses.

- Secretarial audit report: The secretarial audit report must be prepared by a company secretary and must contain information about the company’s compliance with the Companies Act, 2013 and other applicable laws and regulations.

Eligibility for MCA compliance/audit

All companies registered in India are eligible for MCA compliance/audit. There is no specific eligibility criteria. However, the specific requirements that apply to a company will vary depending on its type, size, and industry.

Website Designing

Here are some pre-requisites for web design for clients:

- Clear understanding of the project: The client should have a clear understanding of what they want their website to achieve. This includes the purpose of the website, the target audience, and the key features and functionality that are required.

- Content: The client should provide all of the content that they want to be included on their website. This includes text, images, videos, and other multimedia content.

- Branding: The client should provide their branding guidelines, such as their logo, colors, and fonts. This will help the web designer to create a website that is consistent with the client’s brand identity.

- Budget: The client should have a budget in mind for their website. This will help the web designer to determine what is possible within the client’s budget.

In addition to these pre-requisites, it is also helpful for clients to:

- Be responsive: Clients should be responsive to the web designer’s questions and feedback. This will help to ensure that the website is completed on time and to the client’s satisfaction.

- Be flexible: Clients should be flexible and willing to make changes to their website as needed. This is because it is common for requirements to change during the web design process.

By following these pre-requisites, clients can help to ensure that their web design project is a success.

Here are some tips for clients when working with a web designer:

- Be clear about your goals and expectations. What do you want your website to achieve? Who is your target audience? What are the key features and functionality that you need?

- Provide all of the necessary content. This includes text, images, videos, and other multimedia content.

- Share your branding guidelines. This will help the web designer to create a website that is consistent with your brand identity.

- Be responsive to the web designer’s questions and feedback. This will help to ensure that the website is completed on time and to your satisfaction.

- Be flexible and willing to make changes as needed. It is common for requirements to change during the web design process.

By following these tips, you can help to ensure that your web design project is a success.